Cross Border Fee Real World Comparison

A Personal Guide to Cross-Border Fees: A Real-World Comparison

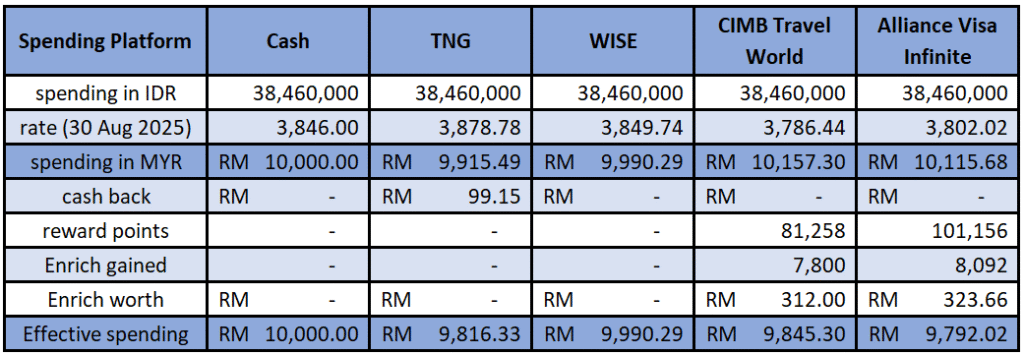

Navigating currency exchange and cross-border transaction fees can be confusing. To shed light on the real costs, I’ve conducted a personal experiment during a trip to Indonesia, spending on a single item worth IDR 64,000 (Indonesian Rupiah) using various payment methods. The results below show a clear comparison of the effective cost and any benefits received.

(A) Cash

Exchanging cash was, by far, the most expensive method. I exchanged Malaysian Ringgit (MYR) to Indonesian Rupiah (IDR) at a rate of RM 265 to IDR 1,000,000 (equivalent to 1 MYR to 3,773.58 IDR).

Effective Cost: The IDR 64,000 item cost RM16.96.

Benefits: No cashback or mileage earned.

(B) Wise Card

The Wise card offers a superior exchange rate but requires reloading via bank transaction. The rates are highly transparent and competitive.

Current Exchange (September 2, 2025): The rate is RM 257.72 for IDR 1,000,000, plus a Wise fee of RM 1.84 (0.714%). This brings the total to RM 259.56 for IDR 1,000,000 (1 MYR to 3,852.67 IDR).

Effective Cost: The IDR 64,000 item cost RM16.61.

Benefits: No cashback or mileage. The only drawback is the need for merchants to accept Visa debit cards.

(C) TNG Visa Debit Card

This card requires a 1% convenience fee for reloading the wallet with a credit card, or you can reload it using DuitNow Transfer, Debit cards, International Options like Panda Remit, Western Union, Wise, Flip-Indonesia and Singtel Dash. It boasts a 0% cross-border fee (at least for now) from TNG.

Effective Cost: The IDR 64,000 item cost RM16.50, with an instant cashback of RM0.08.

Total Cost: RM16.50 – RM0.08 cashback = RM16.42. (Assume that you reload TNG wallet using DuitNow or any alternative without extra convenience fee implied)

Benefits: Instant cashback.

(D) CIMB World Travel Mastercard

This card uses the Mastercard currency conversion rate, with an additional 2% bank fee (1% from Mastercard and 1% from CIMB).

Effective Cost: The IDR 64,000 item cost RM16.90.

Benefits: I earned 135 bonus points (8x rate), which converted to 10.8 Enrich Points, equivalent to RM0.43 in air flight tickets. (Using 1,000 Enrich Points = RM40 worth of air ticket)

Net Cost: RM16.90 – RM0.43 = RM16.47.

(E) Alliance Visa Infinite

This card uses the Visa network charge conversion, with an additional 2% bank fee (1% from Visa and 1% from Alliance Bank).

Effective Cost: The IDR 64,000 item cost RM16.84.

Benefits: I earned 168 timeless bonus points (10x rate), which converted to 11.2 Enrich Points, equivalent to RM0.44 in air flight tickets.

Net Cost: RM16.84 – RM0.44 = RM16.40.

The Final Ranking (Cheapest to Most Expensive)

Based on my personal spending on an IDR 64,000 item, here is the final ranking from most cost-effective to least:

Alliance Visa Infinite: RM16.40 (net cost after rewards)

TNG Visa Debit: RM16.42 (net cost after fees and cashback)

CIMB Travel World: RM16.47 (net cost after rewards)

Wise Debit Card: RM16.61

Cash: RM16.96

This experience shows that a small difference in fees and rewards can add up, with the right credit or debit card often being more cost-effective than using cash or even a specialized travel card.

- Cash conversion used is RM 260 to IDR 1,000,000

- There is an on-going promotion by Touch N Go. you can find the details HERE.

- Wise is charging approximately 0.71% wise fee for this transaction.

- The CIMB Travel World’s Bonus Points are converted during “20% bonus Enrich conversion campaign”, which will be held twice per year. Annual fee of this card will be waived with a certain annual spending, which is excluded in this calculation.

- The Alliance Bank Visa Infinite’s Timeless Bonus Points are converted during “20% bonus Enrich conversion campaign”, which will be held twice per year.

- Conversion rate for Enrich is 1,000 Enrich Points for RM 40.

- Mastercard Currency Convertor Calculator’s LINK

- Visa Currency Converter online’s LINK